Here’s a sobering, inescapable truth: we’re all going to die. It’s a fact that nobody likes to think about for long, but our inevitable demise is a fact of life and keeping it in mind is a necessary part of financial planning.

You shouldn’t let the grimness of the Grim Reaper’s inevitable arrival keep you from making plans—say, setting up a will (unless you like the idea of probate).

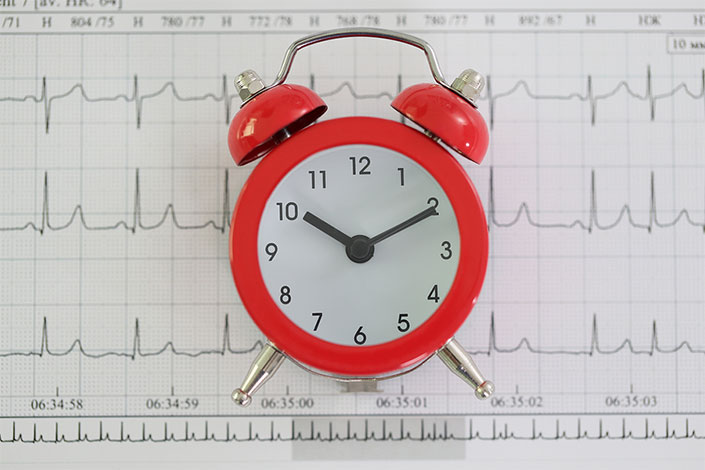

We’ve all heard the timeworn, but sensible, cliché: plan so as not to outlive your money. In other words, if we knew the hour and day of our death, our last cent and last breath might coincide. But we can only guess. And as we age, prognostication looms larger and larger in planning, whether in pension payouts (if you’re lucky enough to have one), when to start drawing from a 401(k), or whether to get (or continue) long-term care insurance.

Younger You, Older You

Financial planning is not just a later-life consideration. When you’re younger, it’s enough to acknowledge time’s passage, so that Younger You keeps in mind the responsibility owed to Older You. Any young person who starts, from their first paycheck, depositing income in a savings account, investing in a 401(k) or IRA, or vesting in a company pension, will look back with gratitude when the advancing years catch up and there’s more available than just Social Security to live on.

Even if Younger You has already taken the steps to secure your financial future, Older You will find a new aspect in making decisions: betting on longevity (or lack of same).

Social Security is a prime example: when should one start taking benefits? Social Security benefits can be claimed after age 62, but you’ll receive a payment reduced by 27.5% . If you wait until full retirement age (that would be age 67 for those who turn 62 as of 2022 and later), you will receive 100% of your benefits, but if you put it off until age 70 (the latest you can wait), you will accrue an 8% credit for each year past full retirement. So, if your payout is $1000 a month at age 67, you will reduce your payment to $725 a month if you opt in at age 62 or increase your payments to a maximum of $1240 a month if you hold on until age 70.

Expiration Date

You may think about ways to take some of the guesswork out of the process. How to figure out our expiration date? Actuarial tables, which calculate the life expectancy and probability of survival for people at different ages, are a useful tool. Life expectancy is calculated using data collected by health systems and by projecting current mortality statistics by age.

Because life expectancy is calculated using averages starting at birth, every death at an early age of someone in your age group can affect your projected number going forward – as can avoiding, say, a deadly strain of flu or surviving a car accident.

In other words, as we age, our life expectancy actually increases, because every birthday means we’ve eluded all sorts of potential fatality.

The table may say you’ll live to age 75. All good: you can set up a budget that leaves just enough for a combination 75th birthday blowout followed by a fancy funeral. Here’s where the quirk comes in: if you reach 75, the table is turned, because it can now say you’ll live to 85. If you get to 85, then you have a good chance to be 90, and as you proceed through a healthy nonagenarian nirvana, 100 becomes achievable.

The tables generally don’t move too far past the century mark (though, who knows, you may reach a Guinness Book of World Records mark before you’re done). If you get to 105 or so, the tables give you about six months more and each year decreases the number of months left. Gender can affect life expectancy, since women tend to live longer.

Conclusion: Plan for the Long Haul

The bottom line is that just as the house always wins at the casino, you can’t really win betting on your life’s end. It’s best to plan for a ripe old age, even if you don’t think you’ll make it.

The best way to get the odds in your favor? Stay active, stay connected to others, and keep your brain and body in good shape. Consult your doctor often.

Talk to your financial adviser when planning. Although you can’t predict your departure date, you can help extend your financial life.

Keep a positive outlook and remember; we’re all in this together.

If you like reading our “Bowen Reports Blogs”, Bowen Asset does have a Facebook page: https://www.facebook.com/BowenAsset Please check it out as we frequently make comments on the page about not just finance and economic events that happen in between our blogs.

As always, if you have any questions about this report or any other questions, please reach out to Bowen Asset at info@bowenasset.com or (610) 793-1001.

Disclaimer

While this article may concern an area of investing or investment strategy in which we supply advice to clients, this document is not intended to constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell securities or investment advisory services. Any statements regarding market or other financial information is obtained from sources which we and/or our suppliers believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. All expressions of opinion reflect the judgement of the author on the date of publication and are subject to change.

Past performance should not be taken as an indicator or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. As with any investment strategy or portion thereof, there is potential for profit as well as the possibility of loss. The price, value of and income from investments mentioned in this report (if any) can fall as well as rise. To the extent that any financial projections are contained herein, such projections are dependent on the occurrence of future events, which cannot be predicted or assumed; therefore, the actual results achieved during the projection period, if applicable, may vary materially from the projections.